Explore the dynamic world of cryptocurrencies through “Bitcoin vs Ethereum: Uses, Communities, Investments, Future”. Discover how Bitcoin’s role as digital gold contrasts with Ethereum’s innovative smart contracts while examining their respective communities, investment potentials, and future outlooks in the evolving digital economy.

Cryptocurrencies have revolutionized the financial landscape, offering decentralized, secure, and innovative alternatives to traditional banking and finance. Among the myriad of digital currencies, two giants stand out: Bitcoin and Ethereum. Both have carved their niches and boast robust communities, but how do they stack up against each other? Let’s dive into the crypto battle: Bitcoin vs. Ethereum.

Bitcoin: The Pioneer

Here are the keynotes for “Bitcoin vs Ethereum: Uses, Communities, Investments, Future”:

- Uses: Bitcoin as digital currency vs Ethereum’s smart contracts and DApps.

- Communities: Bitcoin’s focus on security and scalability vs Ethereum’s developer-driven innovation.

- Investments: Bitcoin as digital gold vs Ethereum’s potential in decentralized technology.

- Future: Outlooks for Bitcoin’s mainstream adoption and Ethereum’s disruptive role in finance and technology.

History and Purpose

Bitcoin, created by the mysterious Satoshi Nakamoto in 2009, is the first cryptocurrency. Its primary purpose is to serve as a digital currency and a store of value. Bitcoin’s decentralized nature and limited supply (capped at 21 million coins) have made it a popular choice as “digital gold.”

Technology

Bitcoin operates on a blockchain, a decentralized ledger that records all transactions. The network relies on a proof-of-work (PoW) consensus mechanism, which involves miners solving complex mathematical puzzles to validate transactions and secure the network. While this system is secure, it is also energy-intensive.

Adoption and Use Cases

Bitcoin’s primary use case is as a store of value and a medium of exchange. Many view it as a hedge against inflation and economic instability. Over the years, Bitcoin has gained acceptance among various businesses, and it’s now possible to buy goods and services with it. Additionally, Bitcoin is frequently used in international remittances due to its low transaction costs compared to traditional banking systems.

Ethereum: The Innovator

History and Purpose Launched in 2015 by Vitalik Buterin, Ethereum is more than just a digital currency. It is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Ethereum aims to be the world’s programmable blockchain.

Technology

Ethereum’s blockchain is also decentralized, but it distinguishes itself with its support for smart contracts—self-executing contracts with the terms of the agreement directly written into code. Initially, Ethereum used a proof-of-work consensus mechanism like Bitcoin. However, it has been transitioning to a proof-of-stake (PoS) model with Ethereum 2.0, which promises to be more energy-efficient and scalable.

Adoption and Use Cases

Ethereum’s versatility has led to a wide array of use cases. It’s the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and countless dApps. Developers use Ethereum to create applications that range from games to financial services, and its smart contract functionality has opened up new possibilities in various industries.

Bitcoin vs Ethereum: Key Differences

1. Purpose:

– Bitcoin is primarily a digital currency and store of value.

– Ethereum: A platform for smart contracts and dApps.

2. Consensus Mechanism:

– Bitcoin: Proof of Work (PoW).

– Ethereum: Transitioning from Proof of Work (PoW) to Proof of Stake (PoS).

3. Transaction Speed and Costs:

– Bitcoin: Slower transactions with higher fees during network congestion.

– Ethereum: Faster transactions, but also faces high fees during peak times; Ethereum 2.0 aims to address scalability and reduce costs.

4. Supply Limit:

– Bitcoin: Capped at 21 million coins.

– Ethereum: No hard cap, but the PoS model aims to make issuance predictable and inflation lower.

5. Development and Community:

– Bitcoin: A more conservative development approach focused on security and stability.

– Ethereum: Rapid innovation and a strong developer community driving new features and applications.

Which One Should You Choose?

The choice between Bitcoin and Ethereum ultimately depends on your investment goals and interests. If you’re looking for a digital currency to hedge against inflation and serve as a store of value, Bitcoin might be the better choice.

However, if you’re interested in the broader applications of blockchain technology and the potential of smart contracts, Ethereum offers a more versatile platform.

Here’s the comparison table for Bitcoin vs. Ethereum based on the provided information:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| History and Purpose | Operates on a decentralized blockchain using a Proof of Work (PoW) consensus mechanism. | Launched in 2015 as a platform for smart contracts and decentralized applications (dApps). |

| Technology | The backbone of DeFi, NFTs, and diverse dApps, enabling developers to create applications across industries. | Initially, PoW, transitioned to Proof of Stake (PoS) with Ethereum 2.0, supporting smart contracts. |

| Adoption and Use Cases | Mainly used as a store of value and medium of exchange, accepted by various businesses and in international remittances. | The platform for smart contracts and decentralized applications. |

| Consensus Mechanism | Proof of Work (PoW) | Transitioning from Proof of Work (PoW) to Proof of Stake (PoS) |

| Transaction Speed | Slower with higher fees during network congestion. | Faster, but also faces high fees during peak times; Ethereum 2.0 aims to enhance scalability and reduce costs. |

| Supply Limit | Capped at 21 million coins. | No hard cap; transitioning to PoS aims for predictable issuance and lower inflation. |

| Development Approach | Conservative, focused on security and stability. | Rapid innovation with a strong developer community driving new features and applications. |

| Primary Use | Digital currency and store of value. | Platform for smart contracts and decentralized applications. |

This table highlights the key differences between Bitcoin and Ethereum, covering their history, technology, adoption, consensus mechanisms, transaction characteristics, supply limits, development approaches, and primary use cases in the cryptocurrency landscape.

So

Bitcoin and Ethereum are both groundbreaking in their own right. Bitcoin introduced the world to the concept of decentralized digital currency, while Ethereum expanded the possibilities of blockchain technology with smart contracts and dApps.

Both continue to evolve, driving innovation in the crypto space. Whether you’re a seasoned investor or a curious newcomer, understanding the strengths and differences of these two giants is crucial in navigating the ever-changing world of cryptocurrencies.

It seems like you’re asking for a structured table or summary of the key points and comparisons between Bitcoin and Ethereum based on the provided information. Here’s a concise table format summarizing their practical uses, community ecosystems, investment perspectives, and long-term outlooks:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| Practical Uses | Digital currency, store of value, global transactions | Smart contracts, decentralized applications (DApps), DeFi |

| Community and Ecosystem | Focus on security, scalability (e.g., Lightning Network) | Developer-driven innovation, DApps, decentralized finance (DeFi) |

| Investment Perspectives | Digital gold, hedge against economic instability | Decentralized technology innovation, the potential for disruption |

| Long Term Outlooks | Mainstream acceptance, robust market presence | Disruptive potential, expanding ecosystem of applications |

This table encapsulates the core attributes and investment considerations for Bitcoin and Ethereum, highlighting their respective roles in the cryptocurrency landscape.

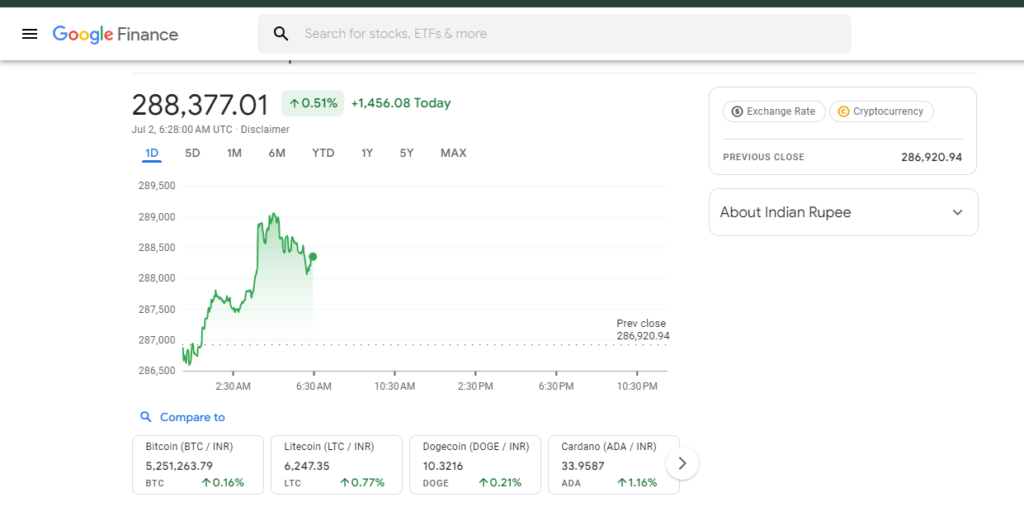

Ethereum

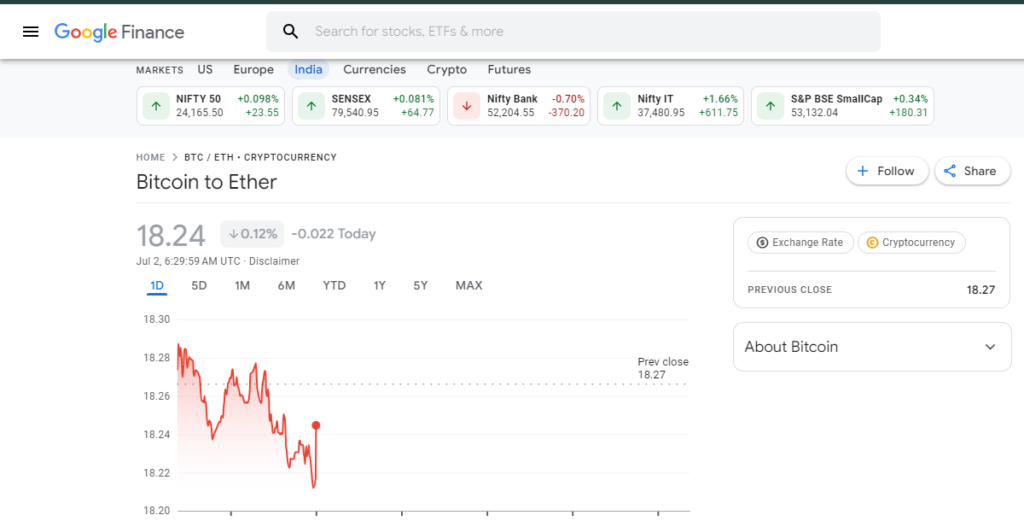

Bitcoin